unemployment tax credit refund

Millions of Americans who collected unemployment benefits last year and paid taxes on that money are in line to receive a federal refund from the IRS this week. This includes unpaid child support and state or federal taxes.

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

. The Internal Revenue Service plans to send back money to 28 million Americans who filed taxes early before legislation that waived. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. This means that you dont have to pay federal tax on the first 10200 of your unemployment benefits if your adjusted gross income is less than 150000 in 2020.

The Child Tax Credit Is Back and Better Than Ever. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up. Amended returns and Applications for Abatement.

The unemployment tax refund is only for those filing individually. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. But the unemployment tax refund can be seized by the IRS to pay debts that are past due.

Dont expect a refund for unemployment benefits. The agency is also making corrections for the earned income tax credit premium tax credit and recovery rebate credit affected by the exclusion. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing.

The 19 trillion coronavirus. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. Complete Edit or Print Tax Forms Instantly.

The 150000 income limit is the same whether you are filing single. The federal tax code counts jobless benefits as taxable income. The IRS has sent.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. The agency said last week that it.

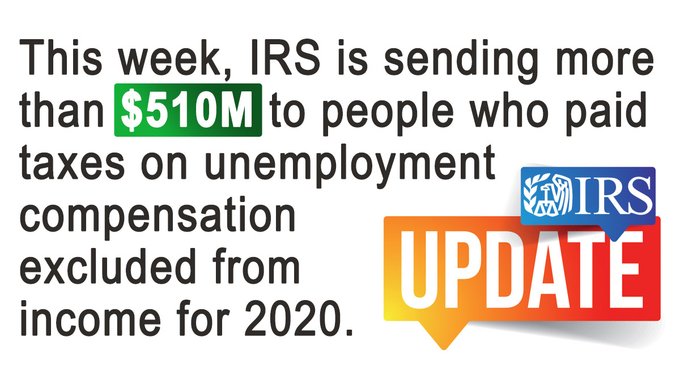

This is the fourth round of refunds related to the unemployment compensation exclusion provision. 22 2022 Published 742 am. The American Rescue Plan Act had waived federal tax on up to 10200 of benefits.

Blake Burman on unemployment fraud. Check For The Latest Updates And Resources Throughout The Tax Season. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. A request for a refund or credit of an overpayment of tax resulting from an amended return or an application for abatement shall be made within the period permitted for abatement of the tax per 830 CMR 62C371 within 3 years from the date of filing of the original return taking into account. By Anuradha Garg.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Unemployment and tax credit rules. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The Child Tax Credit is worth up to 2000 per qualifying child with a refundable portion of up to 1400. This is the latest round of refunds related to the added tax exemption for the first 10200 of. Ad Access IRS Tax Forms.

However because this credit reduces the tax you owe you must have some taxable income to claim it. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. This is not the amount of the refund taxpayers will receive. Child Tax Credit Receiving unemployment income wont prevent you from claiming the Child Tax Credit.

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. Unemployment Federal Tax Break.

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Irs 2020 Tax Refund Unemployment Compensation Still Going Out 10tv Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Taxes Q A How Do I File If I Only Received Unemployment

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Your Tax Questions Answered Marketplace

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Interesting Update On The Unemployment Refund R Irs

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca